|

Crazy and probably stupid investment question.

#3037375

Crazy and probably stupid investment question.

#3037375

04/26/22 09:31 PM

04/26/22 09:31 PM

|

Joined: Apr 2003

Posts: 12,234

Looking for a way out of Middl...

IMGTX

OP

OP

I Live Here

|

OP

OP

I Live Here

Joined: Apr 2003

Posts: 12,234

Looking for a way out of Middl...

|

Let's say you have 100k in your house as equity. S&P 500 pretty much guarantees a 10% reasonably safe return. Interest Rates are at 2% to 3% on a home loan. Let's say you do a cash out refinance and got that 100K in equity in cash and invested it in an S&P 500 fund. It seems to me that the investment would earn more than the interest being paid on the loan. Your home appreciation wouldn't be changed. So you would net net 7% return on your equity that would normally earn nothing. I know there are investments which would earn more money but with better returns come bigger risks so I like the S&P 500 for the lack of risk in this example. It can't be that simple. I know I am missing something here.

|

|

|

Re: Crazy and probably stupid investment question.

[Re: IMGTX]

#3037425

Re: Crazy and probably stupid investment question.

[Re: IMGTX]

#3037425

04/26/22 10:47 PM

04/26/22 10:47 PM

|

Joined: Nov 2003

Posts: 10,228

Colleyville

3hundred

I Live Here

|

I Live Here

Joined: Nov 2003

Posts: 10,228

Colleyville

|

You'd be gambling with your home equity. With recession looking more and more likely, I wouldn't do it. FWIW, my meager portfolio came from savings that are earning nada. I don't have immediate need for the funds so I'm prepared to ride it out. Keeping 3 years living expenses in reserve. https://www.yahoo.com/now/stocks-sink-inflation-recession-fears-184011387.html

'68 Fury Convertible

'69 300 Convertible

'15 Durango 5.7 Hemi

'16 300 S Hemi

|

|

|

Re: Crazy and probably stupid investment question.

[Re: 3hundred]

#3037457

Re: Crazy and probably stupid investment question.

[Re: 3hundred]

#3037457

04/26/22 11:55 PM

04/26/22 11:55 PM

|

Joined: Jan 2003

Posts: 20,183

Park Forest, IL

slantzilla

Too Many Posts

|

Too Many Posts

Joined: Jan 2003

Posts: 20,183

Park Forest, IL

|

How about taxes on the money you make? That would take a good percentage.

"Everybody funny, now you funny too."

|

|

|

Re: Crazy and probably stupid investment question.

[Re: IMGTX]

#3037469

Re: Crazy and probably stupid investment question.

[Re: IMGTX]

#3037469

04/27/22 12:16 AM

04/27/22 12:16 AM

|

Joined: Feb 2015

Posts: 2,079

CA

crackedback

top fuel

|

top fuel

Joined: Feb 2015

Posts: 2,079

CA

|

Home loans aren't 3% anymore. They are in the 5+% for a 30 year now.

You can have big equity draw downs during bad periods. 30-50% from peak levels.

Learn to sell puts or put spreads using the money as collateral. Worst case you buy the shares at a lower price while generating monthly income to pay the fully amortized note. If you get shares put on you, wheel it and sell calls against the stock.

Everything has risk, no free lunches.

Last edited by crackedback; 04/27/22 12:19 AM.

|

|

|

Re: Crazy and probably stupid investment question.

[Re: Stanton]

#3037546

Re: Crazy and probably stupid investment question.

[Re: Stanton]

#3037546

04/27/22 10:19 AM

04/27/22 10:19 AM

|

Joined: May 2019

Posts: 6,279

nowhere

Sniper

master

|

master

Joined: May 2019

Posts: 6,279

nowhere

|

Let's say your home is currently worth $200k and its payed off. Let's say you take that $100k mortgage and invest it. In the future there is a recession (or a a foreign war) and the market tanks - you're investment loses 50%. Then the bottom falls out of the housing market to the tune of 50%. Now your home is fully mortgaged (no more equity) AND you only have $50k in assets. You're so screwed it ain't funny.

I think the wise thing to do if you decided to do this would be to take a few bucks and invest in a tent - so you don't have to scramble for one when you become homeless. Unless he's planning on living off his investments (he can't) he's not going to lose the the house. As long as he can afford to make the payments without the investment income he's ok and no one is going to loan him on his equity if he can't afford to make the payments. Pretty sure no one is going to count potential investment returns as income to pay a loan. The markets will, eventually, recover, stock and housing. I think there are some chicken littles running around. Now to answer the question the OP is asking I think), will he make money on it? Eventually, you might make more in interest than you are paying out in interest, but you still have to pay the principal too. So odds are you will not net anything back to you till the loan is finally paid off. As a long term investment into a safe vessel it might be ok, but I don't know that it's the best way to go. Might just be smarter to put that prospective loan payment into the market instead and eliminate the wait period of paying back the loan.

|

|

|

Re: Crazy and probably stupid investment question.

[Re: LilRed7879]

#3037579

Re: Crazy and probably stupid investment question.

[Re: LilRed7879]

#3037579

04/27/22 11:48 AM

04/27/22 11:48 AM

|

Joined: Nov 2003

Posts: 10,228

Colleyville

3hundred

I Live Here

|

I Live Here

Joined: Nov 2003

Posts: 10,228

Colleyville

|

Not crazy at all but definitely comes with major risks as many have pointed out.

A little different version is in my case I had cash from the sale of some family land and instead of paying off my 2% mortgage, I chose to put it all in the market.

Similar thought process - put into a broad US market ETF and let it earn 7/10% while I continue to pay off the 2% mortgage like normal.

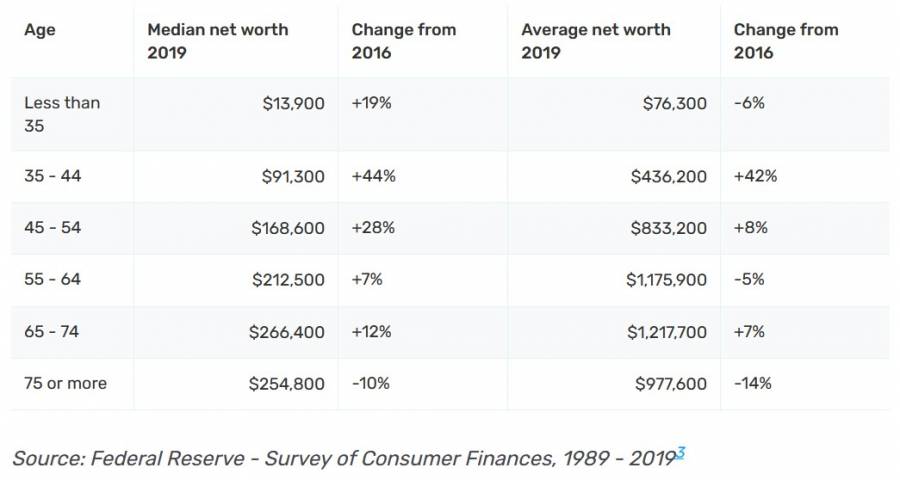

Hopefully, it all works out - I guess for me the key is long term - I can pay the mortgage no matter what happens AND I do not need the money for 10+ years. 7/10%, that's part of the trouble isn't it? With "published" inflation rates ~ 8.5% ( I expect more increases as the fed "fights" inflation) plus long term capital gains tax of 15%, you have to get 9.8% just to break even. If you take short term gains the tax rate is your top rate for income tax purposes. On the other hand, my house is appreciating considerably faster than our income. So your home equity is probably on the rise pretty strongly. For most people in the US today, their net worth (median) IS the equity in their home.

'68 Fury Convertible

'69 300 Convertible

'15 Durango 5.7 Hemi

'16 300 S Hemi

|

|

|

Re: Crazy and probably stupid investment question.

[Re: Sniper]

#3037584

Re: Crazy and probably stupid investment question.

[Re: Sniper]

#3037584

04/27/22 12:06 PM

04/27/22 12:06 PM

|

Joined: Apr 2003

Posts: 12,234

Looking for a way out of Middl...

IMGTX

OP

OP

I Live Here

|

OP

OP

I Live Here

Joined: Apr 2003

Posts: 12,234

Looking for a way out of Middl...

|

Thank you for all the opinions and advice. Very informative and helpful. Just to be clear I am NOT going to get the equity out of my house and invest it. I am to chicken to take financial risks of any kind. I was just toying with an idea I won't follow through on, but it sounded like it may work. Obviously if it was a good idea everyone would do it. Might just be smarter to put that prospective loan payment into the market instead and eliminate the wait period of paying back the loan. This however is an idea I had not thought of and may try.

|

|

|

Re: Crazy and probably stupid investment question.

[Re: IMGTX]

#3064120

Re: Crazy and probably stupid investment question.

[Re: IMGTX]

#3064120

07/31/22 05:10 PM

07/31/22 05:10 PM

|

valeriialol

Unregistered

|

valeriialol

Unregistered

|

You're right that investing in stocks is more profitable than credit histories. But this type of investment should be approached with the utmost forethought. To assess the company's profitability, you need to study all the documents and reviews of this company. To determine if the company was on the verge of bankruptcy and how great the financial outlook was. I chose to buy shares from restaurants and companies producing household chemicals because they are always in demand and therefore have a solid financial position. So if you want to go that route, you can learn more about chick fil a stock . I'd love to hear about your experience with stock purchases.

|

|

|

Re: Crazy and probably stupid investment question.

[Re: IMGTX]

#3064125

Re: Crazy and probably stupid investment question.

[Re: IMGTX]

#3064125

07/31/22 05:32 PM

07/31/22 05:32 PM

|

Joined: May 2005

Posts: 4,733

Florida

BDW

master

|

master

Joined: May 2005

Posts: 4,733

Florida

|

Let's say you have 100k in your house as equity. S&P 500 pretty much guarantees a 10% reasonably safe return. Interest Rates are at 2% to 3% on a home loan. It can't be that simple. I know I am missing something here.  As we've seen it's not simple, S&P is DOWN 25% YTD, and I suspect there's more downside coming. It does average 7-8% over the long haul, but bad timing has bankrupted many who jumped in at wrong time.

|

|

|

Re: Crazy and probably stupid investment question.

[Re: Andrewh]

#3064228

Re: Crazy and probably stupid investment question.

[Re: Andrewh]

#3064228

08/01/22 07:35 AM

08/01/22 07:35 AM

|

Joined: Dec 2007

Posts: 2,684

Des Moines IA

Soopernaut

master

|

master

Joined: Dec 2007

Posts: 2,684

Des Moines IA

|

there is a no risk investment of 10k a year, with I-bonds.

right now the interest is over 9 percent. it is tied to inflation and changes every 6 months.

if you don't need it for over a year it is a good place to park money you don't "need" but don't want to risk either.

worst case it makes 0, but you can't lose money in it. You can also put any tax return of $5000 or less into them. That is in addition to the $10,000 max per year you can purchase otherwise. I've heard of someone overpaying their taxes just for this purpose.

1970 Dodge d100/eventually going on a 77 D100 frame

|

|

|

Re: Crazy and probably stupid investment question.

[Re: 3hundred]

#3064745

Re: Crazy and probably stupid investment question.

[Re: 3hundred]

#3064745

08/02/22 08:46 PM

08/02/22 08:46 PM

|

Joined: Jan 2011

Posts: 15,893

Central Florida

larrymopar360

Stud Muffin

|

Stud Muffin

Joined: Jan 2011

Posts: 15,893

Central Florida

|

Agreed. Volatile market. IF ANYTHING, I'd increase value of my home with the equity e.g. new kitchen, swimming pool, etc. and something you'll enjoy but not put into a volatile market now.

Facts are stubborn things.

|

|

|

Re: Crazy and probably stupid investment question.

[Re: AndyF]

#3064759

Re: Crazy and probably stupid investment question.

[Re: AndyF]

#3064759

08/02/22 09:03 PM

08/02/22 09:03 PM

|

Joined: Jan 2003

Posts: 4,274

Morrow, OH

markz528

master

|

master

Joined: Jan 2003

Posts: 4,274

Morrow, OH

|

This idea works great sometimes. Other times you go bankrupt. 2008 is a good example of what can happen. House prices dropped, the stock market tanked and a bunch of people got laid off. In your situation you would still owe money on the house which wasn't worth what you paid for it. The equity you invested in the market is gone and you just lost your job. If you don't think that can happen then you either were not born yet in 2008, or you didn't pay any attention to what was happening around you.

Right now is an interesting situation to try out what you are suggesting. The market is down 20% but house prices are way up. If you think house prices are going to stay up forever then pull all of your equity out of your house and put it into the stock market. That way when the market goes up you'll make a ton. And if house prices stay high you won't have any problems. But, if the stock market goes down you'll lose part of your equity. If the stock market goes down and house prices drop and you lose your job then you might end up broke with no house. Well said..........

67 Coronet 500 9.610 @ 139.20 mph

67 Coronet 500 (street car) 14.82 @ 94 mph

69 GTX (clone) - build in progress......

|

|

|

Re: Crazy and probably stupid investment question.

[Re: ]

#3077604

Re: Crazy and probably stupid investment question.

[Re: ]

#3077604

09/15/22 06:40 PM

09/15/22 06:40 PM

|

Joined: Jan 2011

Posts: 15,893

Central Florida

larrymopar360

Stud Muffin

|

Stud Muffin

Joined: Jan 2011

Posts: 15,893

Central Florida

|

My favorite "investment" is eliminating ALL debt, especially if you are over 55 years old or so. There is no better investment for your retirement than having no debt. I know people that are headed into retirement with a mortgage or car loan and I think they are nuts. I'd add whatever extra I can even if it's small to additional principal to each payment to pay off mortgage sooner.

Facts are stubborn things.

|

|

|

Re: Crazy and probably stupid investment question.

[Re: IMGTX]

#3077683

Re: Crazy and probably stupid investment question.

[Re: IMGTX]

#3077683

09/15/22 09:48 PM

09/15/22 09:48 PM

|

Joined: May 2003

Posts: 3,075

N.W. Florida

Fat_Mike

master

|

master

Joined: May 2003

Posts: 3,075

N.W. Florida

|

Let's say you have 100k in your house as equity. S&P 500 pretty much guarantees a 10% reasonably safe return. Interest Rates are at 2% to 3% on a home loan. Let's say you do a cash out refinance and got that 100K in equity in cash and invested it in an S&P 500 fund. It seems to me that the investment would earn more than the interest being paid on the loan. Your home appreciation wouldn't be changed. So you would net net 7% return on your equity that would normally earn nothing. I know there are investments which would earn more money but with better returns come bigger risks so I like the S&P 500 for the lack of risk in this example. It can't be that simple. I know I am missing something here.  My answer: Don't EVER gamble your house away. There are far better ways to get where you want to be than to risk being on the losing end of that proposition...

|

|

|

Re: Crazy and probably stupid investment question.

[Re: TJP]

#3077688

Re: Crazy and probably stupid investment question.

[Re: TJP]

#3077688

09/15/22 10:11 PM

09/15/22 10:11 PM

|

Joined: Feb 2015

Posts: 2,079

CA

crackedback

top fuel

|

top fuel

Joined: Feb 2015

Posts: 2,079

CA

|

OK, So is any one savvy enough to go back to the date of the original post, Calculate the idea, and see where the OP would be today ?  Down about 6% 100K invested that day in SPY would be worth about 94K today It would be about flat with a conservative options strategy approach. With an aggressive strategy, the original $417-420 cost basis would be in the 355-360 range.

Last edited by crackedback; 09/15/22 11:33 PM.

|

|

|

Re: Crazy and probably stupid investment question.

[Re: TJP]

#3077701

Re: Crazy and probably stupid investment question.

[Re: TJP]

#3077701

09/15/22 11:14 PM

09/15/22 11:14 PM

|

Joined: May 2003

Posts: 3,075

N.W. Florida

Fat_Mike

master

|

master

Joined: May 2003

Posts: 3,075

N.W. Florida

|

OK, So is any one savvy enough to go back to the date of the original post, Calculate the idea, and see where the OP would be today ?  I "calculated the idea" before I responded. I would NEVER gable my residence to hopefully make some money in the stock market. But, hey....some people are gamblers, and some gamblers are good at it. I'm not one of them.

|

|

|

Re: Crazy and probably stupid investment question.

[Re: tubtar]

#3077778

Re: Crazy and probably stupid investment question.

[Re: tubtar]

#3077778

09/16/22 11:22 AM

09/16/22 11:22 AM

|

Joined: Jan 2003

Posts: 12,432

Warren, MI

71TA

I Live Here

|

I Live Here

Joined: Jan 2003

Posts: 12,432

Warren, MI

|

Buy low , sell high. After that , I got nothing.  FUNNY! My line is, "if it were that easy we'd all be doing it". During the Great Recession my house lost 1/2 its value. Didn't matter cause we werent selling. (This past June we sold at the very top. First time in our lives after 8 homes and dozens of rental property that EVER happened.) So if the loan to equity goes bad in the upcomming recession, and we ALL know its so close you can touch it, the loan would come due and the stock market would be down 25-30-50%. I had a $100k line of equity credit (that we never used). During the Great Recession the bank took that off the table. I'll keep reading. If there are any "how to make a million" without killing myself, I'm all ears (eyes).

|

|

|

Re: Crazy and probably stupid investment question.

[Re: crackedback]

#3077972

Re: Crazy and probably stupid investment question.

[Re: crackedback]

#3077972

09/16/22 10:47 PM

09/16/22 10:47 PM

|

Joined: Jan 2003

Posts: 15,408

Omaha Ne

TJP

I Live Here

|

I Live Here

Joined: Jan 2003

Posts: 15,408

Omaha Ne

|

OK, So is any one savvy enough to go back to the date of the original post, Calculate the idea, and see where the OP would be today ?  Down about 6% 100K invested that day in SPY would be worth about 94K today It would be about flat with a conservative options strategy approach. With an aggressive strategy, the original $417-420 cost basis would be in the 355-360 range. I was just curious  Did you by chance factor in the payments or just the flat 100K? Probably hard to do as the loan costs, and the length of the loan would be unknown variables but would also drive up the loss thanks

|

|

|

Re: Crazy and probably stupid investment question.

[Re: TJP]

#3077977

Re: Crazy and probably stupid investment question.

[Re: TJP]

#3077977

09/16/22 11:02 PM

09/16/22 11:02 PM

|

Joined: Feb 2015

Posts: 2,079

CA

crackedback

top fuel

|

top fuel

Joined: Feb 2015

Posts: 2,079

CA

|

OK, So is any one savvy enough to go back to the date of the original post, Calculate the idea, and see where the OP would be today ?  Down about 6% 100K invested that day in SPY would be worth about 94K today It would be about flat with a conservative options strategy approach. With an aggressive strategy, the original $417-420 cost basis would be in the 355-360 range. I was just curious  Did you by chance factor in the payments or just the flat 100K? Probably hard to do as the loan costs, and the length of the loan would be unknown variables but would also drive up the loss thanks  no, rates have changed a little from about 4.25 to 6% monthly interest only would be 350 at start and about 500 this month. There's also tax rates to consider as well if you want to get deep.

|

|

|

Re: Crazy and probably stupid investment question.

[Re: Sniper]

#3078584

Re: Crazy and probably stupid investment question.

[Re: Sniper]

#3078584

09/18/22 09:35 PM

09/18/22 09:35 PM

|

Joined: Jan 2003

Posts: 15,408

Omaha Ne

TJP

I Live Here

|

I Live Here

Joined: Jan 2003

Posts: 15,408

Omaha Ne

|

i keep getting junk mail that says [if you give] $25.00, it will turn into $75.00. i'm still trying to find out how i can do that for myself !   get a good copier LOL, My wife was making a birthday card with multiple 100 dollar bills and it was flipping amazing other than the paper itself how hard it was to tell the difference. Watched a movie recently where the C/F'r used hair spray to stiffen the bills and create texture  If one did a bunch of 10's or 20's on better paper they could likely slide quite a few    Might be illegal, be careful you know there are a few here that would drop a dime on you. https://legalbeagle.com/7612138-illegal-copy-currency.html Thanks for the info but we're good, only did one side, and yes we changed the scale, it was for a birthday card. But it was flippin amazing to look at the copied paper card next to the real thing and was really hard to tell the difference

|

|

|

Re: Crazy and probably stupid investment question.

[Re: IMGTX]

#3087703

Re: Crazy and probably stupid investment question.

[Re: IMGTX]

#3087703

10/20/22 08:13 AM

10/20/22 08:13 AM

|

Joined: Mar 2022

Posts: 3

USA

russelgarner

member

|

member

Joined: Mar 2022

Posts: 3

USA

|

Yes, this is a good idea for investment, and you may not think that this is a stupid investment, many do, but the percentage of the capital increase will be lower, of course. And it seems that while you are doing all these processes, you will spend a lot of time and effort. In my opinion, it is best to invest money in trading now. Yes, it won't be easy in the beginning because you need to understand how the trading market works, but then the money you invest will work for you. And by the way, I usually read everything about trading and brokers on this site -- https://www.youngandthrifty.ca/the-ultimate-guide-to-canadas-discount-brokerages/. Maybe someone will also be interested.

Last edited by russelgarner; 10/21/22 07:14 AM.

|

|

|

|

|