It don't matter what you tow with.

I operated my racing as a business for 9 years. I spent way more than I won and had some terrific deductions to my personal income. You can only show a lose for 5 years and get maximun deductions.

I talking some pretty big numbers like 150-175K per year spent racing and 20-40k income, made for some great deductions.

I never heard from the IRS and had no trouble.

I had a very knowelagble business man helping me do my taxes. I kept track of all my expense, from hotel rooms, food for my help to fuel to parts to entry fees, license fees, safety SFI fees everything. It's a eye opener how much is spent racing. Each run of my car cost at least 4000-5000 bucks each, I kept track, I know.

Running it as a business has nothing to do with the DOT, that's separate and the DOT don't care if your a business or not. Well they care, I never made it apparent I was racing for money to them. You never tell them your racing, just running your car at test and tunes and not for money. I never lettered my trailers, never.

I had several nice sponsors that helped pay the bills and it was all done above the board. They even asked me to letter my trailer and I said no, they understood. I didn't want to run my truck and trailer commercial by having it lettered and then the DOT looks at you much closer.

I say do it, why not??

Spend a lot of time talking with customers and sponsors, my crew did all the work on the car at the track while I took care of sponsors, not easy.

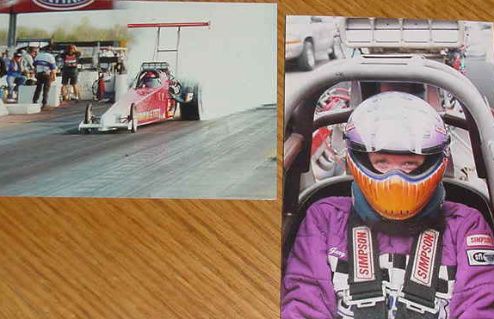

There's nothing else like having a 10000 rpm hemi screaming 12" behind your head!!