Moparts

ebay letter

Posted By: tboomer

ebay letter - 05/11/22 12:45 PM

Did anyone get this from ebay??

eBay

Hi Ted

You may have heard about a new tax law that went into effect this year. We believe this new regulation just doesn’t make sense. It creates confusing and unnecessary paperwork for millions of casual sellers on eBay, who will now receive tax forms even when they don’t owe taxes.

To help support our sellers, we’ve been working to put pressure on Congress by bringing our community together to make their voices heard. We need sellers like you to speak out today and tell Congress to act in the interest of sellers across the US.

Here’s what’s happening

Companies like eBay are required to report sales to the IRS using a tax form called a 1099-K. Until recently, you would only get a 1099-K if you sold over $20,000, or more than 200 items. Starting this year, new legislation has lowered that threshold to just $600, even if that was from a single sale all year. Where it gets complicated is you’ll get this form even if you don’t owe anything, because not all sales are taxable–for example, if you sell something for less than you paid for it. That means millions of sellers will now get unnecessary tax forms, creating confusion and pointless paperwork–both for the IRS, and for small-time sellers who aren’t set up to deal with it.

Imagine selling an old bike for $800 that cost you $1,500 a few years ago. Since you didn’t make a profit, the IRS doesn’t consider that taxable income. But under this new law, you’re still going to get a 1099-K. And now you’ll have to prove to the IRS that you don’t actually owe any taxes on that sale, which makes for complicated accounting work.

Here’s what you can do

We’re asking our community to take action today. Recently, new legislation was introduced in Congress to raise the threshold and limit the number of sellers getting these unnecessary forms. But we need your support to make sure it will pass!

Go to our eBay Main Street website and tell Congress to act now to support Americans selling online. It will only take a few minutes, and if we succeed, it can save you, and millions of other sellers the hassle of needless tax forms for years to come.

Speak out today ➔

We’re committed to making sure all our sellers are set up for success, and will continue to keep you updated. Look for emails and alerts from us that will help explain what’s changed, and what you may need to do next. In the meantime, you can learn more in our FAQ about Form 1099-K and how it affects you.

Thanks for being part of the eBay community.

Posted By: 3hundred

Re: ebay letter - 05/11/22 12:59 PM

Did anyone get this from ebay??

I didn't, but I don't sell on eBay either. And NEVER will as long as the government regards monetizing every no longer needed asset I want to get rid of as a "profit", never even considering inflation. How about that bike I paid $200 for in 1980 I'd be lucky to get $100 for today, did I "profit" $100? Receipt?

You MUST be kidding. I'll throw it out first.

It appears to be legitimate linky

Posted By: moparts

Re: ebay letter - 05/11/22 01:07 PM

Imagine selling an old bike for $800 that cost you $1,500 a few years ago. Since you didn’t make a profit, the IRS doesn’t consider that taxable income. But under this new law, you’re still going to get a 1099-K. And now you’ll have to prove to the IRS that you don’t actually owe any taxes on that sale, which makes for complicated accounting work.

Ebay, Face Book Marketplace and PayPal all are stuck with this reporting to the IRS

And since IRS will still consider your sales as as a hobby you will not be able to show a loss , so from a tax stand point it will be a mess

Posted By: migsBIG

Re: ebay letter - 05/11/22 02:14 PM

Thank you for postin tat info. I sent my letter and let them know they are being bad representatives by making laws like this.

I imagine platforms like ebay are really feeling it in the bottom line as many former sellers are now considering it way more trouble than it's worth to sell their clutter on these sites. I already had stopped listing items there by a few years ago with their ever rising fees and other small seller hurting changes.

They were already shooting themselves in the foot and then the government put another round there!

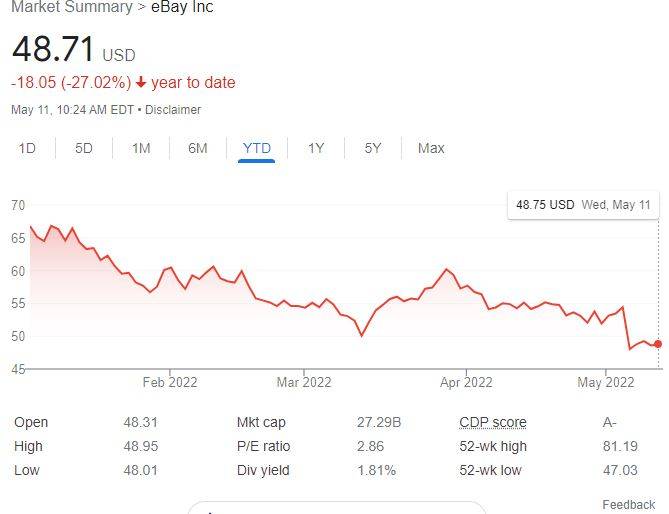

Their stock is down over 25% so far this year.

Posted By: tboomer

Re: ebay letter - 05/11/22 02:48 PM

I filled out the form on e-bag and just got two canned replies from our state senators. I will not go any further as it would break the political rules in the general forum

Posted By: bigdad

Re: ebay letter - 05/11/22 03:12 PM

If you deposit more than $600 into you bank in the form of cash the bank has to report that too now I believe

Posted By: tboomer

Re: ebay letter - 05/11/22 03:31 PM

No kidding? I will call my bank and find out. I have been selling some personal items and I have a couple of high dollar guitars left...

If you deposit more than $600 into you bank in the form of cash the bank has to report that too now I believe

At least they aren't sending you a tax form in January that you have to report the numbers from and justify, or else pay tax on to the IRS....yet

Posted By: bigdad

Re: ebay letter - 05/11/22 03:50 PM

Posted By: bigdad

Re: ebay letter - 05/11/22 03:51 PM

Posted By: ZIPPY

Re: ebay letter - 05/11/22 03:55 PM

I quit selling on ebay some time ago, back when they required direct access to a bank account, because I figured this kind of thing was coming.

It was a shame b/c things were going really good, but paypal was already too intrusive, and ebay just went too far.

They have wanted to do this kind of stuff for decades and finally got around to it.

So, for ebay, the only way to use it to my advantage is to buy but not sell.

And I will send Paypal funds to those who need it, but I won't receive paypal funds.

Stupid to go through that, but I'll sell locally for cash every time instead of all this stuff, if that's what it comes down to.

Posted By: 1972CudaV21

Re: ebay letter - 05/11/22 04:45 PM

Imagine selling an old bike for $800 that cost you $1,500 a few years ago. Since you didn’t make a profit, the IRS doesn’t consider that taxable income. But under this new law, you’re still going to get a 1099-K. And now you’ll have to prove to the IRS that you don’t actually owe any taxes on that sale, which makes for complicated accounting work.

Ebay, Face Book Marketplace and PayPal all are stuck with this reporting to the IRS

And since IRS will still consider your sales as as a hobby you will not be able to show a loss , so from a tax stand point it will be a mess

You can write-off losses and depreciation on items you’ve sold. Tricky, but it can be done.

Is this the next step: Will the IRS bother Moparts because they have classified ads?

Posted By: Brad_Haak

Re: ebay letter - 05/11/22 05:11 PM

If you deposit more than $600 into you bank in the form of cash the bank has to report that too now I believe

At least they aren't

sending you a tax form in January that you have to report the numbers from

and justify, or else

pay tax on to the IRS....yet

You mean like PayPal does already?

Posted By: 70Duster

Re: ebay letter - 05/11/22 05:13 PM

You can write-off losses and depreciation on items you’ve sold. Tricky, but it can be done.

Yes. you can calculate your cost basis for the items you sell, but who keeps the receipt to show how much they originally paid for that bike they bought 25 years ago, and who wants to go through the hassle of the book keeping for such sales? That item you bought at the yard sale for $100 cash and sold on ebay for $200. Do you have a receipt for the $100? If not the IRS says you pay tax on the full $200 since if you get audited and you can't produce a receipt, you can't claim the proper cost basis.

I quit selling on ebay back in February because I was very close to the $600 limit and I'm not dealing with a K-1 come tax time.

And, as far as that letter is concerned, ebay is the one with the deep pockets. Perhaps they need to do some good old political lobbying instead of leaning on their customers for help. Ebay has deteriorated every year over the last decade and I don't really care what happens to them at this point.

Posted By: Brad_Haak

Re: ebay letter - 05/11/22 05:27 PM

You guys know that all this was triggered many years ago when state and local governments saw they were losing their expected tax income from local sales & services to online sales from out of state businesses where people weren't paying any taxes, right?

So, if you want your roads paved and your police paid... and the original source of the funds has dried up or decreased dramatically due to massive increases in online sales w/o taxes, what's the solution? Make the online vendors collect and submit the taxes, or raise your local taxes (again) on something that can't be side-stepped... like your property taxes.

Not saying I like the solution, but it certainly makes sense. And the interesting thing -- well, I think it's interesting -- is the first person I heard get on a soapbox about needing to tax online sales was the owner of a local speedshop who is no longer in business. And this was at least 20 years ago when he was going off about it.

If you deposit more than $600 into you bank in the form of cash the bank has to report that too now I believe

At least they aren't

sending you a tax form in January that you have to report the numbers from

and justify, or else

pay tax on to the IRS....yet

You mean like PayPal does already?

Of course, what’s your point?

Posted By: bigdad

Re: ebay letter - 05/11/22 06:26 PM

Our dirtbag governor started the whole process of collecting taxes ..he is gone now but, that's where it all came from

https://apnews.com/article/146e7b6402444130865655a623920fff

Posted By: poorboy

Re: ebay letter - 05/11/22 06:50 PM

Like anything government related, upset customers carry more weight then upset companies.

They know you are mad, they just want you to tell the government you are mad.

For the record, calling your congress people at the Washington DC switchboard office has more of an effect then sending them a letter. The letters get filed in the circular file unless it is something they agree with, or if you request a response. If you request a response, you get the generic letter that doesn't mean squat.

If you call the DC switchboard, all those calls are recorded and counted, so be NICE, and tell them what you don't like.

I got a 1099K from Paypal for 2020 for around $2000. From what I was told later when I mentioned that, I was told several states including my garbage state required this reporting a year earlier. I had no records to back up what I paid for items I'd sold, some payments were from a friend who paid me several times over the years and I hadn't noticed he'd neglected to select friends and family for the funds he sent me.

I stressed about it when doing my taxes, and reported a few hundred of those payments as profits just to be on the safe side even though I am not sure any of that $2000 was actually profit. I learned my lesson, I didn't get a 1099 from Paypal for 2021, because I am wary of selling anything any more. Which is too bad as I still have stuff I'd like to get rid of, but it has become more trouble than it is worth.

I can agree that it is wrong that some people have been running profitable businesses and cheating on their taxes on their sales, and this new move may help crack down on that. But the net was cast too wide and really caused a lot of problems for many people who just want to do what is the equivalent as have a garage sale.

Posted By: AndyF

Re: ebay letter - 05/11/22 07:09 PM

The IRS is already overwhelmed so next year when they start getting a bunch of low dollar transactions to track they'll too buried to see straight.

I don't know if it will impact me or not. I have a few customers who pay with PayPal but I track all of that in my own books so I don't think it will matter if PayPal sends me a 1099. It should just match what I already have on my books. I can see how this rule change would blow up a side gig that someone had going. The people who are going to be really annoyed are the ones who sell one high dollar item on PayPal but have no paperwork on what they paid for it. If it was me I'd probably ignore the 1099 unless it was for a bunch of money. Be interesting to see if the IRS actually dings anyone for selling a $600 used car part.

Posted By: hemi70se

Re: ebay letter - 05/11/22 07:14 PM

What is this about Facebook sending 1099K's? I don't think you are correct. It's all supposed to be about 3rd party money transfers. I have discontinued using Paypal and Venmo. I have listed a few items on Facebook but if I sell it I usually remark that it was sold elsewhere so I don't have to deal with the feedback hassle.

Posted By: 1972CudaV21

Re: ebay letter - 05/11/22 08:09 PM

What is this about Facebook sending 1099K's? I don't think you are correct. It's all supposed to be about 3rd party money transfers. I have discontinued using Paypal and Venmo. I have listed a few items on Facebook but if I sell it I usually remark that it was sold elsewhere so I don't have to deal with the feedback hassle.

On Facebook, if you sell an item for over $600.00, you will receive a 1099 for the sale. My advice: Do not ship the item on FB, do not pay anything to FB to enhance the ad, nor indicate that it is “sold” on FB. Instead, only sell locally for cash and delete the advertisement immediately after selling. Beyond this, you could list it on CL and direct potential buyers to contact you on CL or to selling sites like this one.

Posted By: Brad_Haak

Re: ebay letter - 05/11/22 08:24 PM

If it was me I'd probably ignore the 1099 unless it was for a bunch of money. Be interesting to see if the IRS actually dings anyone for selling a $600 used car part.

Funny you mention this... cuz reading this thread reminded me that my PP 1099 for a few parts sales may not have been factored into the 2021 filing.

Posted By: Brad_Haak

Re: ebay letter - 05/11/22 08:34 PM

... I am wary of selling anything any more...

Understood. I don't want to sell w/ PP any longer cuz of this 1099 PITA, and I don't sell on eBarf any longer cuz their fees, etc., are "disincentives".

Posted By: MadMopars

Re: ebay letter - 05/11/22 09:20 PM

The fact remains, Ebay has a broad reach and as a result generally seems to net quicker sells at higher prices. Granted, the fees do cut into profits but price it accordingly. Much like taking home a paycheck the fact remains, if you're making money, you're getting taxed. Does it suck for the little guy? Sure. Did some abuse the system and screw it up for everyone? Sure. However, if you think your going to make money with these items rotting in the garage, it's never gonna happen.

Posted By: HotRodDave

Re: ebay letter - 05/11/22 09:58 PM

The fact remains, Ebay has a broad reach and as a result generally seems to net quicker sells at higher prices. Granted, the fees do cut into profits but price it accordingly. Much like taking home a paycheck the fact remains, if you're making money, you're getting taxed. Does it suck for the little guy? Sure. Did some abuse the system and screw it up for everyone? Sure. However, if you think your going to make money with these items rotting in the garage, it's never gonna happen.

Between the fees and now taxes and associated time and headache is it really getting you that much more for your junk?

This is just one more thing putting a damper on the already stalled economy, less people selling stuff because it ain't worth the hassle means we all have less money so we buy less stuff and it just circles the drain.

... I am wary of selling anything any more...

Understood. I don't want to sell w/ PP any longer cuz of this 1099 PITA, and I don't sell on eBarf any longer cuz their fees, etc., are "disincentives".

Yes it’s very frustrating, I’ve lived in the same house for 30 years and have gathered a few million things during that time. I’m happy to pay eBay or whomever a % to find a buyer, I don’t need a big tax headache and stress from a 1099. Nor should I have to, I’m not selling stuff to make a living. I have a good paying full time job and investments so I pay more taxes than most Americans. For years we took things like ebay for granted, I sold a few hundred items there from 2002 until a few years ago. Now I don’t know where to go to get rid of much of what I still have. Car parts, I can list on car sites like here. Other types of stuff, I’m now sol.

“You don’t know what you got, until it’s gone” a song once said. Glad I was able to find new homes for many things while I had the chance, I wish I’d been more ambitious and got rid of more and would have had I known what the future held.

Posted By: AndyF

Re: ebay letter - 05/11/22 10:31 PM

If it was me I'd probably ignore the 1099 unless it was for a bunch of money. Be interesting to see if the IRS actually dings anyone for selling a $600 used car part.

Funny you mention this... cuz reading this thread reminded me that my PP 1099 for a few parts sales may not have been factored into the 2021 filing.

I'm not sure anyone knows how the IRS is going to handle this. They'll get flooded with these low dollar amount 1099's that don't match the 1040 info and then I don't know what they'll do. They don't have the bandwidth to make a federal case out of every missing 1099 form. They might send automated letters requesting information or something like that.

I'm not sure what I'll do when I report income since only a small number of my customers pay with PayPal. So I'll get a 1099 form that doesn't match what I report as income and there will not be an easy way to reconcile. It is basically just random information that will confuse the issue of income reporting. My guess is after a couple of cycles of this the politicians will hear enough that they'll make some changes. Maybe raise the limit back up to $10,000 or something like that.

Posted By: 1972CudaV21

Re: ebay letter - 05/11/22 10:32 PM

... I am wary of selling anything any more...

Understood. I don't want to sell w/ PP any longer cuz of this 1099 PITA, and I don't sell on eBarf any longer cuz their fees, etc., are "disincentives".

Yes it’s very frustrating, I’ve lived in the same house for 30 years and have gathered a few million things during that time. I’m happy to pay eBay or whomever a % to find a buyer, I don’t need a big tax headache and stress from a 1099. Nor should I have to, I’m not selling stuff to make a living. I have a good paying full time job and investments so I pay more taxes than most Americans. For years we took things like ebay for granted, I sold a few hundred items there from 2002 until a few years ago. Now I don’t know where to go to get rid of much of what I still have. Car parts, I can list on car sites like here. Other types of stuff, I’m now sol.

“You don’t know what you got, until it’s gone” a song once said. Glad I was able to find new homes for many things while I had the chance, I wish I’d been more ambitious and got rid of more and would have had I known what the future held.

There has to be a new way to sell things without government interference. If you bought an intake 20 years ago for $100.00 and sell today for $100.00, it’s not fair for the government to tax it IMO. I have some ideas, but I’m not ready to discuss here.

Posted By: Neil

Re: ebay letter - 05/11/22 11:51 PM

Exactly, Used stuff should not cost the seller any tax as you already paid it.

I use Ebay for buying way more than selling. Their fees are absurd now + you get strange people on there who pay slow and leave no feedback ect.

If you sell stuff on CL, or the swap meets, for too cheap flippers or local hoarders grab it that is no good either. Lots of the local Mopar project cars and desirable parts are being held hostage by a handful of older guys who are waiting for the prices to keep going up so they can make $$$ later. They grab deals and then just put the stuff on the shelf until the price far exceeds what they paid for it.

Posted By: klunick

Re: ebay letter - 05/12/22 12:28 AM

Pretty much looks to me that most folks have quit selling on Ebay. Only "companies" on there now. For cars it usuallyisn't there car,just some showroom selling cars way overpriced for others.

Posted By: TB3CUDA

Re: ebay letter - 05/12/22 12:53 AM

sounds like craigslists will pick up with adds now.i got the ebay notice,like everyone else quit selling on there a while back,and facebook isnt much better,even sites like moparts and forbbodiesonly,can have its problems,next swapmeets will want your sales info for the day,didnt laysons get arrested in pa over something like this a few years ago?

Posted By: Neil

Re: ebay letter - 05/12/22 01:21 AM

They were selling parts with Chrysler part numbers without permission I think. Told not to and kept going anyways.

Posted By: poorboy

Re: ebay letter - 05/12/22 01:51 AM

Its not that hard to set up a part time business, and the benefits outweigh the effort. The business would pay the expenses involved with the sales, and that could end up reducing your overall taxable income.

Get hooked up with a good accountant and they can tell you what can legally be written off as expenses, and what is considered income. Then, when you get the Ebay form, you tell your accountant that "That is covered in my "income" section".

The next thing is, who cares what you paid for something 20 years ago? The government only wants to see a receipt that says you paid $$$ for something and see what you sold it for. You can buy receipt books pretty cheap. Its not hard to find an old receipt for something you may have bought last year and sold this year, for a profit or a loss. A receipt from Joe's Garage Sale for 'this item' for this 'amount' of cash is all you need. Its not your problem to remember where "Joe's Garage Sale" place was, you have the receipt for the part you sold. If the receipt from Joe's wasn't in your hand writing, it would probably be better.

Posted By: migsBIG

Re: ebay letter - 05/12/22 01:57 AM

I filled out the form on e-bag and just got two canned replies from our state senators. I will not go any further as it would break the political rules in the general forum

I got 4 replies back, 3 from the same rep and the third reply was them showing actual concerns about this law.

Posted By: TJP

Re: ebay letter - 05/12/22 02:00 AM

If you deposit more than $600 into you bank in the form of cash the bank has to report that too now I believe

That was overturned likely due to the banks had a bit more influence over our elected officials. I believe the limit is still 10K for a single transaction before a flag goes up. But i wouldn't test the waters by making too many high $$ deposits.

And yes I filled the letter out and spoke with my representatives. My understanding is EBay is still working very hard to get this overturned to a more reasonable number. The more that bi-ch th e more likely something will change

Posted By: SomeCarGuy

Re: ebay letter - 05/12/22 03:36 AM

The IRS is already overwhelmed so next year when they start getting a bunch of low dollar transactions to track they'll too buried to see straight.

I don't know if it will impact me or not. I have a few customers who pay with PayPal but I track all of that in my own books so I don't think it will matter if PayPal sends me a 1099. It should just match what I already have on my books. I can see how this rule change would blow up a side gig that someone had going. The people who are going to be really annoyed are the ones who sell one high dollar item on PayPal but have no paperwork on what they paid for it. If it was me I'd probably ignore the 1099 unless it was for a bunch of money. Be interesting to see if the IRS actually dings anyone for selling a $600 used car part.

A 1099 of any sort will trigger an automated red flag if the numbers don’t match up to your return. It’s like a pseudo audit to start and you’ll need to respond in some way, which could be cutting a check for the amount they are seeing as not reported or explain it away with this receipt bs.

Posted By: migsBIG

Re: ebay letter - 05/12/22 03:52 AM

Creating a business would be a good starter, if you sell enough to be a business. For guys like me that sell maybe a couple or 3 parts a

Month to clear the yard or to help out older friends that don’t want to do computers Ana’s Craigslist, then it’s a waste of time. If you sell a bunch and decide to go the business route, you can then write off a bunch of stuff and can take 3 years of loses and be very limited on taxes then. Either way, $600 cap means the government is trying to, we’ll, affect the lower class income.

Posted By: AndyF

Re: ebay letter - 05/12/22 04:21 AM

The IRS is already overwhelmed so next year when they start getting a bunch of low dollar transactions to track they'll too buried to see straight.

I don't know if it will impact me or not. I have a few customers who pay with PayPal but I track all of that in my own books so I don't think it will matter if PayPal sends me a 1099. It should just match what I already have on my books. I can see how this rule change would blow up a side gig that someone had going. The people who are going to be really annoyed are the ones who sell one high dollar item on PayPal but have no paperwork on what they paid for it. If it was me I'd probably ignore the 1099 unless it was for a bunch of money. Be interesting to see if the IRS actually dings anyone for selling a $600 used car part.

A 1099 of any sort will trigger an automated red flag if the numbers don’t match up to your return. It’s like a pseudo audit to start and you’ll need to respond in some way, which could be cutting a check for the amount they are seeing as not reported or explain it away with this receipt bs.

If the IRS wants the returns to match the 1099 then they'll need to rewrite the return forms because right now there isn't a box for ebay or paypal income. So nothing is going to match unless they rewrite the forms.

Posted By: RTSE4ME

Re: ebay letter - 05/12/22 11:33 AM

If you deposit more than $600 into you bank in the form of cash the bank has to report that too now I believe

That was overturned likely due to the banks had a bit more influence over our elected officials. I believe the limit is still 10K for a single transaction before a flag goes up. But i wouldn't test the waters by making too many high $$ deposits.

And yes I filled the letter out and spoke with my representatives. My understanding is EBay is still working very hard to get this overturned to a more reasonable number. The more that bi-ch th e more likely something will change

I was wondering why my bank stopped asking me questions when I made a large withdrawal. They wanted to know what the money for , I always told them hookers and blow.

I only accept cash/MO/check when I sell anything over $500

Posted By: Mr T2U

Re: ebay letter - 05/12/22 11:59 AM

If you deposit more than $600 into you bank in the form of cash the bank has to report that too now I believe

i have a friend who owns a independent euro car repair business with over 2 million in yearly sales.

he was complaining about how his new bank hates cash. he was thinking about changing back to his old bank with higher fees just because of this.

Posted By: 70Duster

Re: ebay letter - 05/12/22 12:09 PM

If the IRS wants the returns to match the 1099 then they'll need to rewrite the return forms because right now there isn't a box for ebay or paypal income. So nothing is going to match unless they rewrite the forms.

Unfortunately, tax law isn't as simple as filling in numbers in a specific box for a specific document that you receive.

Tax law and IRS publications say that you should report the sale of collectibles on Form 8949 and Schedule D as long or short term capital gains.

If what you're selling isn't considered a collectible, then it's considered a business which involves filling out Schedule C for the income tax, and schedule SE for the self employment tax that will be due in addition to the regular income tax.

The additional forms filed increase the chance for an audit. And without proper receipts necessary to substantiate the correct cost basis for each item, it's just not worth the hassle. Maybe we need to stick to Craigslist or revive the local newspaper classifieds again to keep third parties out of small transactions when you're just trying to clean out the basement or garage .

Posted By: 6PakBee

Re: ebay letter - 05/12/22 12:26 PM

If you sell stuff on CL, or the swap meets, for too cheap flippers or local hoarders grab it that is no good either. Lots of the local Mopar project cars and desirable parts are being held hostage by a handful of older guys who are waiting for the prices to keep going up so they can make $$$ later. They grab deals and then just put the stuff on the shelf until the price far exceeds what they paid for it.

I thought that was the American way to make money, buy low, sell high.

Posted By: poorboy

Re: ebay letter - 05/13/22 01:11 AM

You all should be complaining to your congressional people where it might make a difference, not here or not to e bay, they are pretty much in the same boat you are in.

The congressional switchboard number is 202-224-3121.

Tell them your name and where you live. Tell them you want to speak with your State Representative and your State Senator, and the reason you want to speak with them. The information is cataloged and everyone will know you were concerned about this issue. Be very nice to the person you speak with.

They will either give you a number to call for each representative or Senator, or they may connect you to their office. Then call, or talk, with the person in that office. It will likely be an office worker, but it could be your representative. Again, be very nice and tell them what you want, and why. These calls to the Fed Government are all recorded, don't be abusive or say stupid stuff!

If enough people get involved, it does make a difference, sometimes.

Posted By: TJP

Re: ebay letter - 05/13/22 02:04 AM

You all should be complaining to your congressional people where it might make a difference, not here or not to e bay, they are pretty much in the same boat you are in.

The congressional switchboard number is 202-224-3121.

Tell them your name and where you live. Tell them you want to speak with your State Representative and your State Senator, and the reason you want to speak with them. The information is cataloged and everyone will know you were concerned about this issue. Be very nice to the person you speak with.

They will either give you a number to call for each representative or Senator, or they may connect you to their office. Then call, or talk, with the person in that office. It will likely be an office worker, but it could be your representative. Again, be very nice and tell them what you want, and why. These calls to the Fed Government are all recorded, don't be abusive or say stupid stuff!

If enough people get involved, it does make a difference, sometimes.

I do have to Comment what roasts my rhoids is,

They Taxed us on the income we made while working.

They Taxed us again when we bought the items

Now they want to TAX us a 3rd time if we sell using a TPO unless of course we can PROVE that we're not making a profit on something that who knows when it was bought or otherwise acquired.

I understand the desire of capturing those that were making a living by reselling items and not reporting the income. But dropping from 20K a year to 600.00 was obviously aimed at the middle to lower income classes.

What happened to the campaign promises to go after to corporations and upper 10-20% that pay little or nothing?

IF they really wanted to level the field a flat across the board sales tax should be implemented doing away wit all other forms of taxation.

An individual / corporation is now taxed on what they spend. So if you're Warren Buffet and live as he does (frugally) that is how you are taxed. On the other hand if your Gates, trump or anyone else that lives more lavishly, you're e taxed accordingly. SIMPLE

It also captures all that illegal unreported income when Guido buys his new Lambo.

In Addition all those IRS employees can be furloughed and fill the jobs at McDonald's, wally world etc. That in itself would make a good dent in Gov. spending, Save a bunch of trees etc. Then dump the "Do not Call registry" which is doing nothing except adding to the deficit. I could go on but my point has been made and I hope it is not deemed to political. If so I apologize up front

Posted By: Rhinodart

Re: ebay letter - 05/16/22 10:00 PM

I don't worry about getting audited, I am a small fish and it would cost the taxpayers more to go after me than it is worth. If they want to take everything I own then good luck to you. Just ask 20% more than your stuff is worth, that will pay the tax or your item won't sell, no skin off my back...